How to trade binary options

Binary options are short-term, limited risk contracts. On Nadex, you can trade binary options with different strike prices based on the possible probability of the outcome. Learn how to trade binary options and the ways you can use these contracts in your trading plan.

Binary options trading is a process, and the traders who are successful have their own plans and strategies. This process can be broken down into five key stages – it’s important to follow each one carefully if you’re going to become a successful binary options trader.

How to trade binary options in 5 steps

Know the market trends.

Pick the market you want to trade.

Select a strike price and expiration.

Place your trade.

Wait for expiration, or close out your trade early.

1. Know the market trends

Binary options trading is a simple process of choosing a strike based on a yes or no question: will this market be above this price at this time. If you think yes, you buy. If you think no, you sell.

That’s the easy part. However, you need to go into your trading with market knowledge and clear predictions – otherwise, how can you answer that simple question? Every trader has their own opinions and predictions, based on their perceptions of what’s already happened, what’s coming up, and what they think this means for future market movements.

Of course, nobody can see into the future, and even trading experts who’ve been diving into the markets for years can’t say for sure what will happen. But what you can do is make strong predictions; market forecasts and financial events are always open to interpretation. It’s up to you as a trader to put your own spin on things.

One of the most interesting aspects of financial markets is their relevance to the wider world. The events that affect our everyday lives – politics, current affairs, international relations, business developments, technology releases, and much more – can also affect the markets.

To be a well-informed trader, you first need to be a well-informed individual, with a good overview of world events and what they mean for the economy.

This means staying up-to-date with the news, following world affairs, and learning how these can affect markets. Here are some ways to get started:

Learn how to conduct your own technical analysis.

Use the Nadex charts available in the platform.

Explore fundamental analysis and what this can tell you about the markets.

Attend a Nadex webinar on market analysis.

Follow financial news and monitor the economic calendar.

2. Pick the market you want to trade

Once you know your markets, you’re ready to pick the ones you want to trade. This will depend on a whole host of factors, including:

Contract duration – markets may have intraday, daily, or weekly binary option contracts available to buy or sell. See Nadex Binary Option contract specifications for stock indices, forex, commodities, and events.

Choosing the right level – it’s all about finding the ideal strike, meaning you’ll need to pick a market that offers the right opportunities according to your trading plan. More on that in the next step!

Personal interests – certain markets will capture your interest more than others. Perhaps you’re interested in US politics and the way they can move the dollar? Maybe you like to focus on oil, and the complex issues surrounding supply and demand? Each trader tends to become more absorbed in particular markets that match their own interests.

On Nadex, you have a choice of four markets:

Learn more about the markets you can trade on Nadex, so you can find the ones that offer the right opportunities for you.

3. Select a strike price and expiration

Selecting your strike price can be one of the most challenging aspects of trading binary options when you’re starting out. The contracts themselves are structured very simply, but that doesn’t mean the trading process is easy: you need a plan, a strategy, and a prediction.

While there’s always the possibility of losing money as a trader, this outcome is far more likely if you jump into binary options trading without thinking it through.

The key to selecting a binary option strike comes down to two main factors: probability and risk. It’s a balancing act, requiring you to find a strike where you believe the outcome is possible, and you’re comfortable with the level of trading risk you’re taking on, too.

To get a rough idea of probability, just find the mid-point between the contract's bid and offer price – the prices that sellers and buyers are paying, respectively.

Let’s look at an example of the strikes available for a five-minute binary option contract on EUR/USD:

What would be the thought process behind picking between these strikes? Why would one be more appealing to you than another?

You need to bring your market predictions to the table and think analytically. When looking at each strike, focus on the probability and risk angle: do you think the strike is achievable, and if so, is it the right price level for you?

Looking at the strikes available, the bottom one is in-the-money (ITM). Using the method of finding the midpoint, you get 63 – this means there’s around a 63% probability of EUR/USD being above 1.0865 in three minutes and 48 seconds. The probability of it remaining in-the-money is higher, so the price is higher, too.

If, however, you think the market is likely to reverse and move below the strike of >1.0865, you also have the option to sell the contract – and the profit you’d stand to make from this is higher, because the probability of that happening is lower.

The same goes for each of the other contracts; you need to consider the risk and reward. You could buy a contract with a strike of >1.0867 for a price of $37.50, meaning a potential profit of $62.50. However, the probability of this happening is only around 35.25%, as this is the midpoint between the bid and offer price.

This is just one example, covering one market and option duration. Binary option contracts are available with five-minute, twenty-minute, two-hour, daily, and weekly durations. This gives you an additional choice to make when picking your market; it will depend on your trading style, the markets you favor, and the economic events coming up. Durations can clearly be seen next to each underlying market in the Nadex platform.

4. Place your trade

Once you have decided on your strike, it’s a simple process to place your trade. When you click on the strike, either at the left-hand side of the screen or on the chart itself, your order ticket will be brought up.

You can click between the buy and sell buttons, and choose whether you’re going to place a limit order or a market order. You’ll also need to fill in the size box, which is the number of contracts you want to buy or sell. Toggle between them and explore your options – you’ll clearly see your maximum potential profit or loss calculated underneath.

When you’re ready, simply choose place order.

5. Wait for expiration, or close out your trade early

If you’ve placed a market order in a liquid market, it should be filled immediately and will show up in the ‘positions’ window at the bottom of your screen. If you’ve placed a limit order, you may need to wait and see if this is filled. In this case, it will show in the ‘orders’ window. If it’s filled at the price you have selected, it will move into the ‘positions’ window. From here, you’ll be able to monitor your trade until expiration.

Trades don’t always go as planned (and that’s why you should only ever trade with capital you can afford to risk). If you find that the markets are moving against you, though, the other option is to close out early and limit your losses. Equally, you might find that the markets are moving in your favor and choose to close out early, taking a smaller confirmed profit. If you wait until expiration, the markets could move against you, risking your contract settling at 0.

Take a look through the examples below to see how this works in practice.

Binary options trading examples

You’ve followed our step-by-step guide, showing you how to trade binary options from start to finish. So what about the outcome? Here are some trading examples, worked through from start to finish, showing you how to trade binary options in a real-life scenario.

Binary option trading example no. 1: closing out early

Closing out early is an option if you want to secure your profit at the current market price, or limit losses if your trade isn’t working out for you.

In this example, you decide on the commodities market, and want to place a trade on gold. There’s a great deal of market volatility, and as gold is usually a safe haven, you think the market may move higher – it’s been trading down all morning.

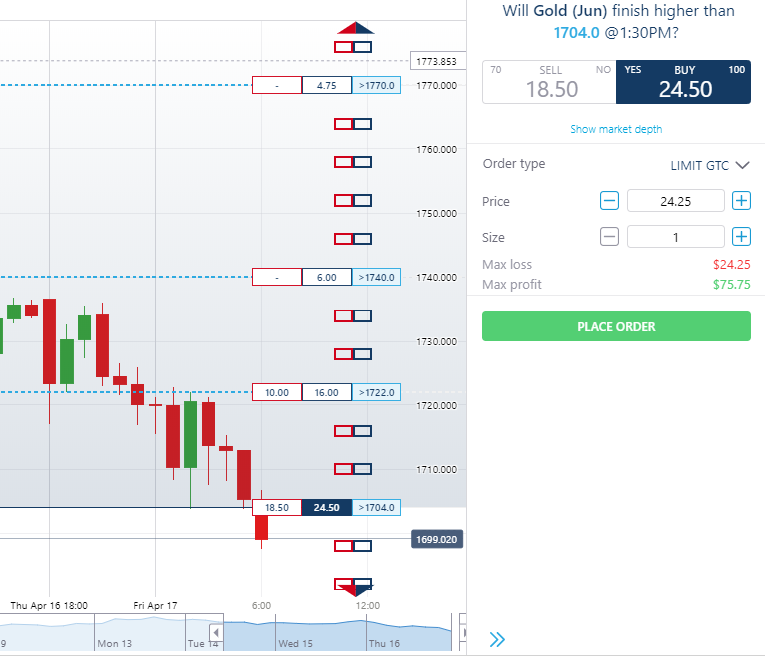

The price of a binary option contract is typically based on the likelihood of a particular outcome happening. The Gold (Jun) contract >1704.0 @ 1.30 p.m. has an offer price of $24.50, giving a risk-to-reward ratio of more than 3:1.

The market would have to move quite significantly to achieve this – by buying this binary option, you are predicting that the price of gold will be above 1704.0 at 1.30 p.m., even though it’s currently only 1699.020. However, if the contract is the right level according to your trading plan, you may buy this contract for $24.50 at 6:32 a.m. (knowing you can always close out early if the market rallies or starts to fall).

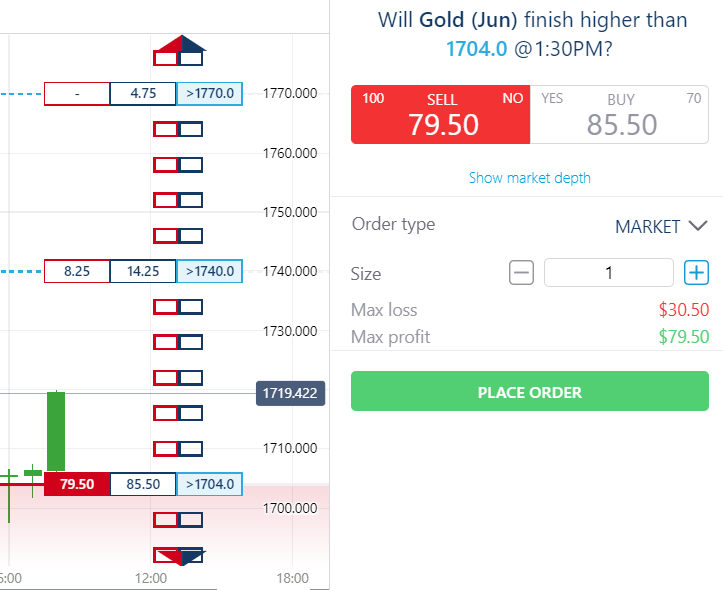

At 8:53 a.m., the market has rallied to 1719.316. This puts you comfortably in-the-money, and you decide you’d like to take your profits, in case the market reverses – after all, there is still a long time to go until expiration. The sell price is $79.50, so you choose to sell one contract using a market order to offset your earlier buy order.

You bought for $24.50 and sold for $79.50, and $79.50 - $24.50 = $55.00. This means you’ve made a profit of $55.00 on this trade, excluding exchange fees.

Binary option trading example no. 2: trading five-minute binaries

Earlier, we touched on five-minute binary option contracts and the different trade set-ups. Let’s see what the outcome of a trade would have been at expiration, for all possible scenarios.

These were the strikes available with three minutes and 48 seconds until expiration:

The expiration value was 1.08679. These would have been the outcomes for each strike, based on buying or selling with three minutes 48 seconds until expiration:

| Strike | Buy outcome* | Sell outcome* |

| >1.0873 | 0 | $0.25 profit |

| >1.0871 | 0 | $2.25 profit |

| >1.0869 | 0 | $11.25 profit |

| >1.0867 | $62.50 profit | 0 |

| >1.0865 | $34.75 profit | 0 |

*Excluding exchange fees. Note: exchange fees would have made the 1.0873 strike an unprofitable outcome overall.

Learn more about how to trade 5 minute binary options.

Binary option trading example no. 3: holding the contract to expiration

If you are confident in your trade and think the markets will prove you right, you may choose to hold your trade until expiration.

For this example, let’s look at a binary option contract based on the US 500 index.

You think the index could move higher, and see there has been a strong upward move the previous day – plus, the index has been trading higher all morning. However, there is still some turbulence, so you don’t want to risk too much capital on a contract – you’re concerned the market could reverse and move against you.

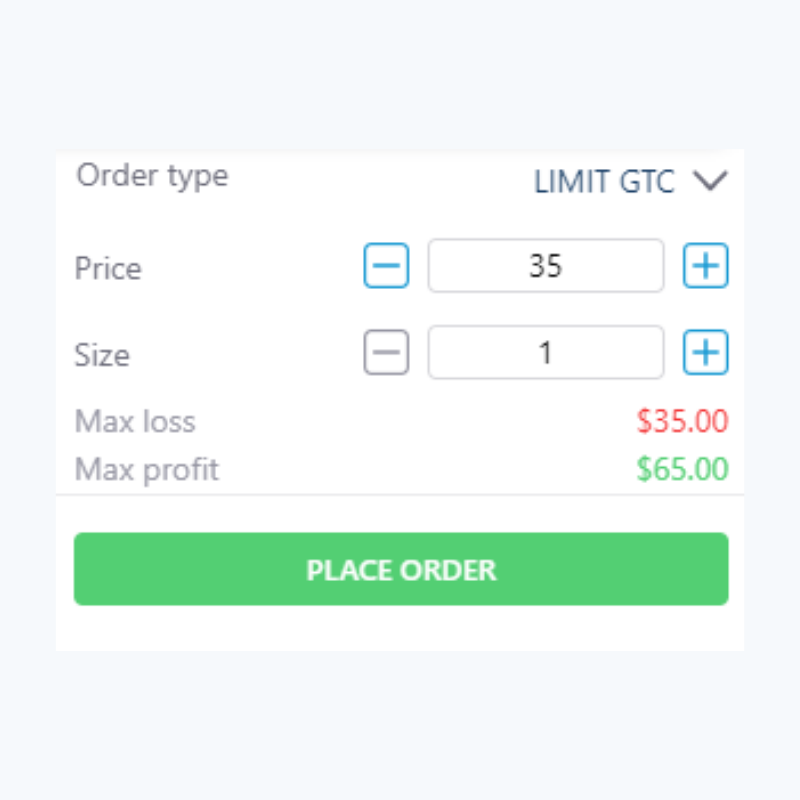

You pick the strike >2846.9 (10 a.m.), meaning you think the underlying market will be higher than 2846.9 at 10 a.m. The market price is $40.25, however you don’t want to pay more than $35.00, so you enter this figure into the ‘price’ box and place a limit order to buy at 9:31 a.m. The order is filled at 9:32 a.m.

As you can see from the order ticket, your maximum loss is $35.00 (the amount you paid to enter the trade), and your maximum profit is $65.00, excluding fees.

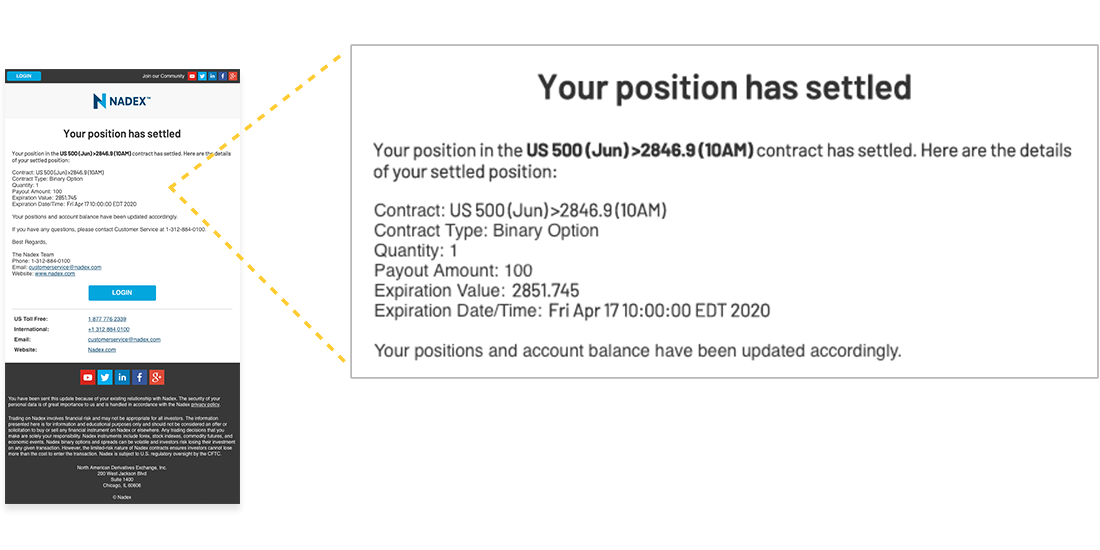

At 10 a.m., you receive an email telling you that your position has settled.

The expiration value is higher than your strike of >2846.9, meaning your prediction was correct and your payout amount is $100.00. This means you make a profit of $65.00, excluding fees.

How to trade binary options: further learning

By now, you should have a good understanding of the binary options trading process, as well as a good idea of how to make your own decisions (based on your personal trading plan). Before you can start trading binary options, you’ll need to know your way around the platform – why not check out the platform tutorials in our learning center?

Further reading:

What are binary options and how do they work?

How to read candlestick charts

What is a strangle strategy using binary options? (This is a more advanced strategy to try out when you’re feeling confident in how to trade binary options.)

Once you know your way around the platform and understand how binary options work, it’s time to practice! Download your Nadex demo account and start practicing - $10,000 in virtual funds are waiting for you.

Binary Options FAQs

What are binary options?

Binary options are a financial instrument that provide a fixed payout if the underlying market moves beyond the strike price. You decide whether a market is likely to be above a certain price, at a certain time. Trading a binary option is like asking a simple question: will this market be above this price at this time? If you think yes, you buy, and if you think no, you sell. Nadex Binary Options enable traders to predict the outcome of an underlying market’s movement. Learn more about how binary options work.

How do binary options work?

There are three key elements that make up a binary option contract:

The underlying market. This is the market you choose to trade.

The strike price. The strike price is central to the binary option decision-making process – to place a trade, you must decide if you think the underlying market will be above or below the strike.

The expiration date and time. You can trade binary options lasting for up to one week, with durations as short as five minutes.

Learn more about how binary options work.

Are binary options legal?

Yes, binary options are legal to trade with a regulated provider in the US. It’s not just legal to trade binary options in the US – it’s regulated, has low capital requirements, and is accessible to retail traders. Look out for CFTC regulation to make sure the exchange you are trading on has legal oversight to protect you against unscrupulous market practices. Additionally, ensure the exchange is based in the US and that you trade your own account. Learn more about how binary options are regulated.

Is binary options trading risky?

It can be! Here are some steps to follow so that you can trade binary options more securely:

Only trade with a CFTC regulated exchange.

Don’t engage with anybody who claims to be a broker, or who says they can trade your account for you.

Trade your own account.

Try trading binary options on a regulated exchange for free! The best way to trade more confidently is through practice on our binary options demo account with $10,000 in virtual funds.

How do binary traders make money?

Binary traders can make money by correctly predicting whether a market will be above a specific price at a specific time. At expiration, you either make a predefined profit or you lose the money you paid to open the trade. Binary options are priced between $0 and $100. Each contract will show you the maximum you could gain and the maximum you could lose. If your trade is successful, you receive a $100 payout, so your profit will be $100 minus the money you paid to open the trade. If your trade isn’t successful, you don’t receive a payout. This means you lost your capital, but nothing else, because your risk is capped.

What's the difference between options and binary options?

Binary options are short-term, limited risk contracts with two possible outcomes at expiration – you either make a predefined profit or you lose the money you paid to open the trade. The payoff is fixed on either side of the strike price. Options, also called vanilla options, have a payout that is dependent on the difference of the strike price of the option and the price of the underlying asset on one side of the strike price while fixed on the other. Options can be complex, difficult to price, and have the potential for outsized profits or losses.

What's the minimum deposit for a binary options trade?

At Nadex, you can open a live account for free - that's right, no minimum deposit required. Binary trades at Nadex are priced between $0 and $100, excluding exchange fees. The cost to place a trade is always equal to the maximum risk, plus any trade fees, which is required to be in your account when the order is placed. Not ready for a live account? You can practice trading binary options for free with our binary options demo account.

Back to Help

Back to Help